Table of Content

Our experienced specialists will help you every step of the way – and if you decide that predictable monthly payments for a fixed term is best for you, they’ll help you with a Fixed-Rate Loan Option. Bank of America Home Loans offers FHA, VA, jumbo, conforming, and conventional mortgages. First American’s acquisition of Bank of America’s lien release business is an important step in the company’s plan to expand its mortgage offerings. With this acquisition, the company has expanded its position as a leader in title insurance and risk management solutions for the real estate industry. The teller always feels like there isn’t enough money to work with, so he works overtime. It offers incredible benefits in addition to starting a child banking account and a paid vacation for parents who are expecting or adopting a child.

If you're struggling with your Bank of America home equity loan or line of credit payments, there may be options to change the terms to achieve more affordable payments. To learn more about relationship-based ads, online behavioral advertising and our privacy practices, please review Bank of America Online Privacy Notice and our Online Privacy FAQs. If you prefer that we do not use this information, you may opt out of online behavioral advertising. If you opt out, though, you may still receive generic advertising. In addition, financial advisors/Client Managers may continue to use information collected online to provide product and service information in accordance with account agreements. Your monthly payment may fluctuate as the result of any interest rate changes, and a lender may charge a lower interest rate for an initial portion of the loan term.

Bank of America® Rewards Savings

Select the About ARM rates link for important information, including estimated payments and rate adjustments. Prequalification, as opposed to preapproval, requires the lender to conduct a thorough check on your information. Furthermore, the company will perform a credit check on you to ensure that you have a good credit score.

If you are a Preferred Rewards member, you can expect to see a $200 to $600 deduction from your mortgage origination fee. In general, Bank of America’s mortgage refinance rates are lower than those offered by other large banks. The Bank of America score for customer satisfaction is higher than that of other large banks.

Programs in West Virgnia

By clicking Continue, you will be taken to a website that is not affiliated with Bank of America and may offer a different privacy policy and level of security. Bank of America is not responsible for and does not endorse, guarantee or monitor content, availability, viewpoints, products or services that are offered or expressed on other websites. Please be advised that some of the Global ATM Alliance partner websites may be in languages other than English.

A home loan with an interest rate that remains the same for the entire term of the loan. Unlike an interest rate, however, it includes other charges or fees to reflect the total cost of the loan. Bank of America Home Loans is offered by Bank of America (NMLS #399802), a bank founded in 1784 and based in Charlotte, NC. Bank of America Home Loans are available in 50 states . To find an authorized vehicle dealer near you, enter a City, State or Zip Code to start your search and use "refine your search" to narrow down your options based on specific dealer or vehicle brand.

Start online

In recent years, the bank has come under fire for a number of scandals, including its role in the subprime mortgage crisis and its involvement in the manipulation of the London Interbank Offered Rate . Despite these challenges, the bank remains one of the largest and most powerful financial institutions in the world. As his five-person family outgrew its Chicago apartment, Johnson Bam was looking to buy a home.

You're continuing to another website that Bank of America doesn't own or operate. Its owner is solely responsible for the website's content, offering and level of security, so please refer to the website's posted privacy policy and terms of use. Find local resources through HUD's homeowner counseling services and understand your foreclosure prevention options. If you have a Fannie Mae or Freddie Mac loan, you may be able to modify your loan to make your payments more affordable.

How Long Does Bank Of America Take To Close A Mortgage?

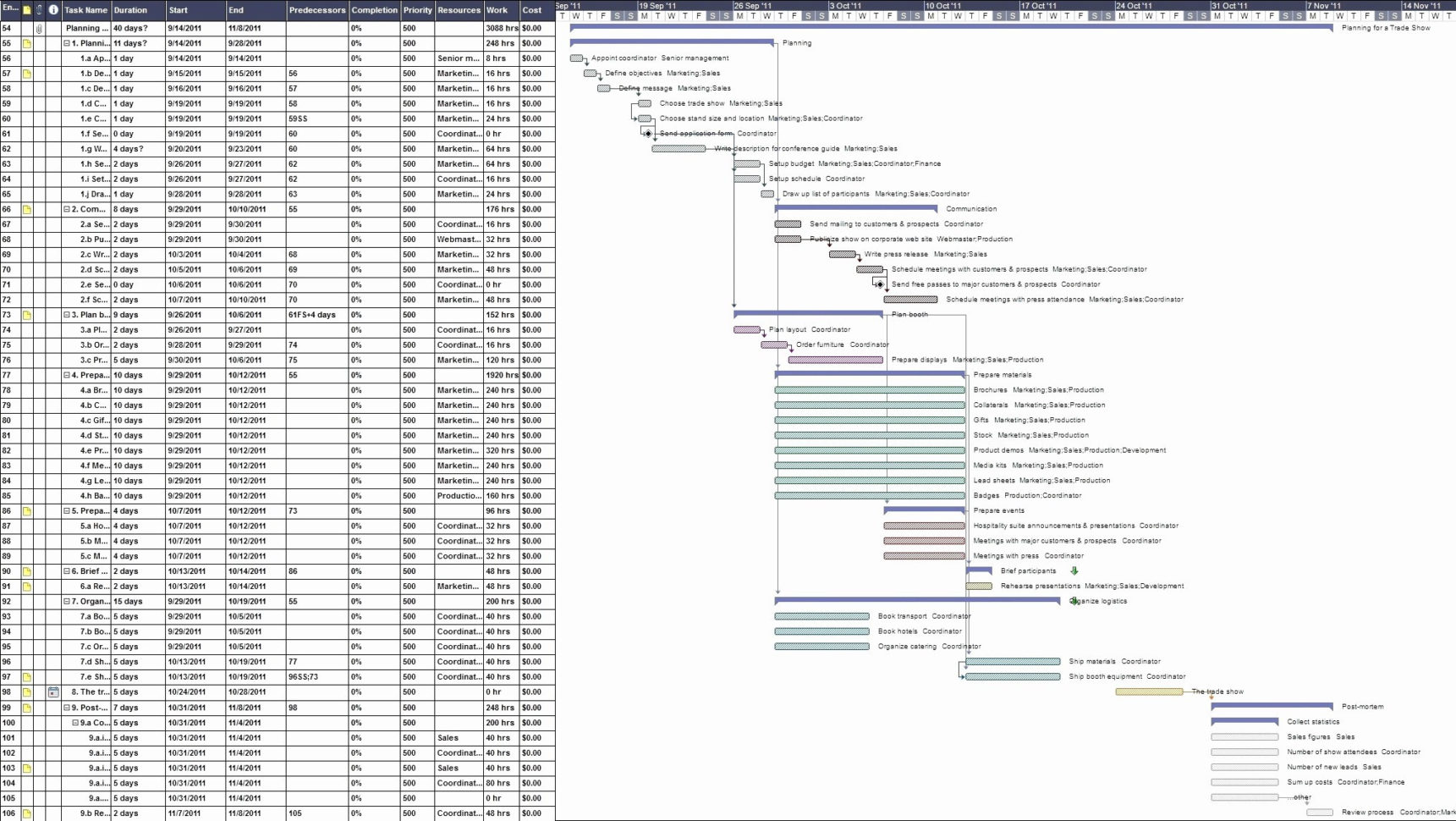

Chart data is for illustrative purposes only and is subject to change without notice. Advertised rate, points and APR are based on a set of loan assumptions . Chart accuracy is not guaranteed and products may not be available for your situation. Monthly payments shown include principal and interest only, and , any required mortgage insurance.

Bank of America today announced it will triple its affordable homeownership initiative to $15 billion through 2025, aiming to help more than 60,000 individuals and families to purchase homes. Every home buyer can benefit from additional knowledge and support. Whatever our customers’ life stage or circumstances, we help them make informed decisions with robust resources and expertise. And/or mailing address for the purpose of fulfilling your home buying process inquiry regardless of any Do Not Call or other privacy choices you may have previously expressed. If you are experiencing a financial hardship related to the coronavirus, we may be able to postpone home loan payments for three months or longer.

According to sources, Bank of America increased the terms of its mortgages and required a down payment. If the bank matches a competing rate offer, it will no longer issue price exceptions. In November, the bank assigned each salesperson an automatic phone line. The salespeople are upset that they are told to only use the line for business-related calls.

Manage your account and make payments using our top-rated Mobile Banking app and Online Banking. In order to provide you with the best possible rate estimate, we need some additional information. Please contact us in order to discuss the specifics of your mortgage needs with one of our home loan specialists. We endeavor to ensure that the information on this site is current and accurate but you should confirm any information with the product or service provider and read the information they can provide.

We understand that buying a home is big decision and it may seem more complex now than you originally expected. That’s why we created this edu-series so you can easily access free tools and Better Money Habits® content to plan and prepare for your journey. If you can't sell your house, you may be able to settle your loan by signing the house over to your lender. The details of this estimate requires some additional assistance from one of our loan specialists.

Bank of America mortgage reviews on Yelp are generally positive, with customers praising the bank’s customer service and mortgage options. However, there are a few complaints about the bank’s mortgage process, including its application and approval process. Overall, Bank of America is a well-respected mortgage lender with a good reputation among customers. Employees in the banking sector used to be paid based on their relationship with customers during the credit-adjustments industry. Insider spoke with four people who claimed that CSAs now receive higher salaries based on the branch in which they work. Salespeople preferred a more stable commission structure to one that was uncertain.

No comments:

Post a Comment